Blog

Managing our future with electric vehicles

By Leslie Dang Ngoc

The idea of electric vehicles driving themselves on our streets seemed like a sci-fi fantasy even just a few short years ago.

Today, the rapid advances in machine learning, autonomous technology and battery storage capacity has drawn us closer to this reality. We are fast approaching a future where the iRobot Aldi RSQ of electric, self-driving cars is well within our reach.

“The future of cars is autonomous,

connected, electric and shared.”

Jeff Desjardins – Visual Capitalist

Electrifying fleets of vehicles comes with its own set of challenges and opportunities for governments, utilities and manufactures to overcome. Here we explore the trend towards electric vehicles and what this means for our grids and energy leaders.

So… what is an electric vehicle?

Image: Electric vehicle – image source Fontera

For the purpose of this article an electric vehicle (EV) (sometimes referred to as an electric drive vehicle) is a vehicle which uses one or more electric motors for propulsion. Electric vehicles can store electricity in an energy storage device, such as a battery. They include battery electric vehicles, plug-in hybrids or hydrogen fuel cell electric vehicles.

Electric vehicles are here.

While it took eight years (2007 to 2015) to reach the symbolic figure of 1 million electric vehicles on the road, in 2017 alone, 1.2 million were sold across the globe. This momentum is unlikely to slow as battery capacity increases and prices continue to fall. In fact, it is more than likely the uptake of electric vehicles will accelerate at rate difficult to fathom. It is foreseen that electric vehicles global market share will be 20% by 2030 (Global Electric Vehicle Outlook, 2018).

Fuelled by government support, advocates and policy makers are setting aggressive electric vehicle targets. In Norway, for example, the Norwegian parliament recently set the goal for all new cars to have zero emissions by 2025.

Hundreds of new electric battery and plug-in hybrids announced.

On all accounts, electric vehicles are not just a blip on the horizon. Traditional car manufacturers have made a strategic shift and have announced a total of over 165 new electric (battery and plug-in hybrids) models by 2025. (From a traditional industry built on the backbone of fossil fuels the this demonstrates a huge shift thinking.)

The trend towards electrification is gaining momentum. Earlier this year as part of the reformation strategy – post dieselgate scandal – the Volkswagen Group announced it will invest 9 billion euros to roll out 20 electric models by 2025. Almost 15 million cars will be produced in the first wave of its electric-car rollout.

Similarly, Audi, BMW, and Mercedes-Benz are all launching high-profile electric cars in 2019, and practically every major automaker is staking its future on lineups of fully electric vehicles.

Incumbents face competition from fast-moving and innovative companies with an all electric DNA such as Tesla and Nio. Both companies are thinking differently about the future of transport and have created inspiring market offerings. While Tesla struggles to keep up with the growing demand for its luxury vehicles, Nio has gained momentum positioning it as the first in an expected wave of Chinese-based electric-vehicle upstarts.

Electric vehicles are not just private passenger vehicles

While private passenger vehicles receive the bulk of attention when it comes to electric vehicles the landscape of commercial vehicles, and public transportation is also being reshaped.

Congested city centres with strict emission regulations are prime targets for deploying electric buses and electric taxi fleets. In Shenzhen – one of the fast-growing Chinese megacities – all 16,000 buses are now electric, with the local taxi fleet (22,000) soon to follow. Bloomberg calculates that China adds about 9,500 electric buses every five weeks—the size of London’s entire fleet. This is enough volume to impact on the global demand for oil.

Similarly, the restriction of large trucks in city centres is driving the adoption of light electric commercial and delivery vehicles. DHL one of the largest logistics companies in the world is targeting adoption of green vehicles for 50% of their European fleet by 2025. To kick off efforts DHL started StreetScooter to build electric trucks and vans for its own DHL fleet. Today the subsidiary is emerging as an important electric vehicle manufacturer in its own right.

Charging – the other side of the coin.

Image: Electric vehicle charging – image source Kārlis Dambrāns

While an electric vehicle future seems inevitable, the infrastructure required to charge the batteries is still in its infancy. Charging could become a bottleneck for electric vehicle penetration.

Public charging infrastructure is a key enabler to electric vehicle uptake. Significant investments into public charging are still required. According to a report released by McKinsey, there are currently over 400,000 public charging points supporting more than 3 million electric vehicles globally. GTM Research predicts growth in electric vehicle sales to boost demand for charging points, with up to 40 million installed by 2030.

To date, the adoption of electric vehicles, notably in the US, has been by affluent suburban households with access to home parking and charging. As prices fall and more affordable models come to market, electric vehicles will become increasingly mainstream. Many future customers will not have access to home charging. Private parking is a lot more challenging to access in densely populated cities. In Europe and Asia private parking is almost non-existent with mostly on street or commercial parking.

These factors have caused governments to consider public charging infrastructure and the overall impact it may have. Considerations include, how to optimise the location and placement of charging stations, how to standardise charging hardware, and how to implement fast charging.

Paving the way for fast charging.

Image: Tesla fast chargers – image source Jag_cz’s

Currently there are a number of fast charging national suppliers such as Greenlots, EVgo, Ecotricity, Charge Your Car and Polar Network with free, pay-as-you-go and subscription based payment models available. Their fastest chargers are typically, 50 kW. These charging stations can only get us so far. Work is being done to overcome the limitations with 50kW DC fast chargers being deployed globally. This type of high-powered charging enables vehicles to be charged in 30 min vs. 8 hours for a home charger, or 4 hours for an AC fast charger. Ultra fast 350kW chargers and wireless charging are part of the next wave of charging technology and have recently hit the market.

Tesla’s Supercharger network, designed specifically for Tesla vehicles, is marketed as the standard to which all other electric vehicle infrastructure should aspire. The Supercharger, which operates up to 120 kW, can charge a Tesla in about 30 minutes.

The impact of these fast chargers on the demand for energy should be considered when looking at investment in public infrastructure.

Electric vehicles affecting the grid at a local level and reshaping the peak load curve.

In most countries, our energy grids (transmission and distribution networks) will be stretched to satisfy the growing adoption of electrical vehicles on the road. The shift in demand from fossil fuels to electrics will result in transmission and distribution networks having to provide more capacity and transport higher volumes of energy. In the UK, growth in electric vehicle use could require a potential demand of 8GW power generation. Innovative load balancing techniques will be needed to ensure this demand can be met.

However, when we look at aggregate nation-wide impact of electric vehicles on peak load, the result overall is minimal. The recent McKinsey study shows electric vehicles will only represent a 1% increase in peak load in Germany by 2030.

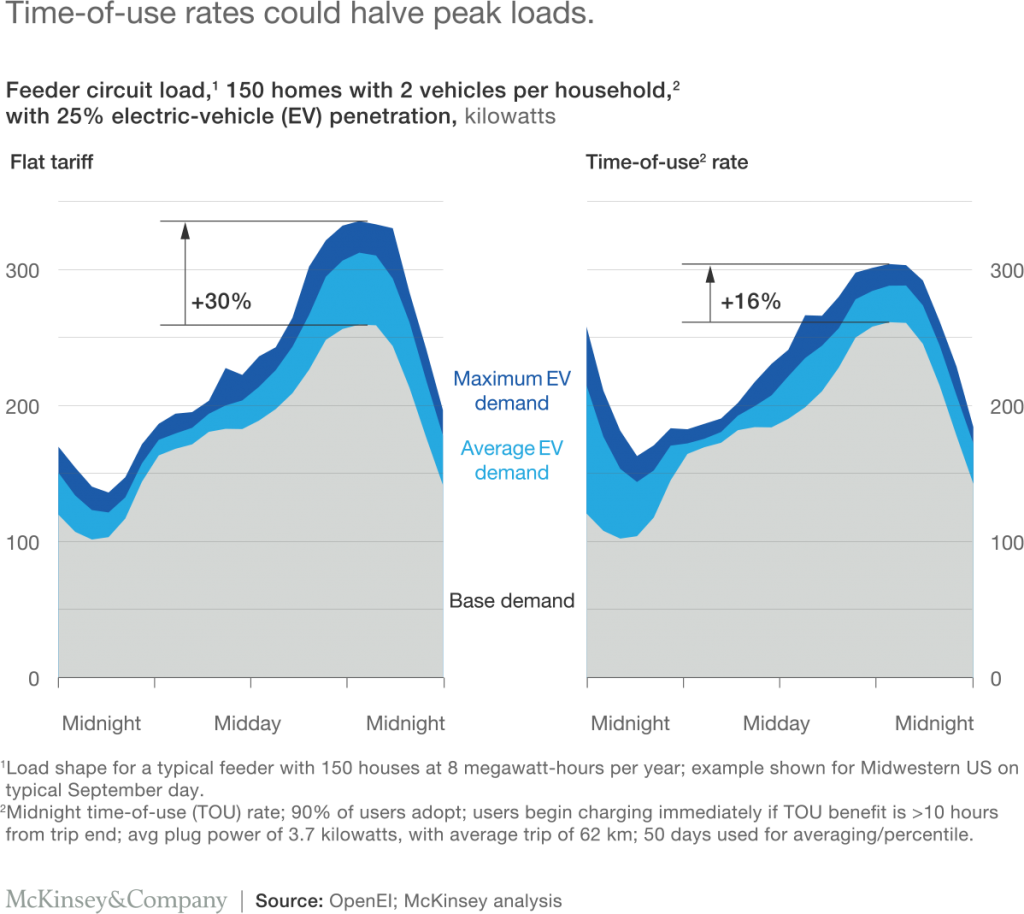

While electric vehicles are unlikely to create a power-demand crisis, they do have the potential to reshape the load curve. The most pronounced effect will be an increase in evening peak loads, as people plug in their electric vehicles when they return home from work or after completing the day’s errands.

Image: Load profiles for fast charging stations fluctuate wildly – image source McKinsey & Company

The same study also demonstrated that a 25% adoption of electric vehicle in any given high density residential area triggers a 30% increase in local peak load. The residential pockets with large electric vehicle penetration, charging depots for electric buses or commercial vehicles, or locations with fast public chargers are all local hotspots that have the potential to strongly impact the grid at a local level.

Some of the effects are currently partially mitigated by time of use rates targeting mainly residential users, with lower rates for charging during off peak hours.

Image: Time of use tariffs – image source McKinsey & Company

The main challenge resides in managing the effect of fast charging station on the grid. Peak demand of a fast charger may be 80 times higher than energy use of a typical household. As a result public charging station operators may face demand charges representing up to 90% of their electricity bill.

One of the solutions to this issue has been in locating a battery next to the charging station. The battery charges when a vehicle is not present. When a vehicle arrives it is charged from the battery to prevent high energy costs when demand is high. As utilisation of charging stations increase with demand charges absorbed by many electric vehicles, the stationary batteries may be used to provide grid services.

Powering the future – electric vehicles as a readily-available energy storage source.

Vehicle-to-grid is a hotly debated topic. (This is a system whereby power demand from electric vehicles may be shifted but also the electric vehicle batteries may throttle to feed energy back into the grid to provide demand response and grid services such as frequency regulation, peak shaving and spinning reserves is compelling. Especially in jurisdictions where traditional forms of storage, back-up or peak supply are unavailable or expensive.)

As more and more households invest in electric vehicles, more and more homes will effectively have a large electricity storage device (capable of powering the average home for several days) in their garage.

It’s not too difficult to envision a future in which consumers become prosumers by storing and selling energy back to the grid, using the batteries in their electric cars as a distributed, mobile energy storage system.

This provides an interesting way to monetise an electric vehicle, provided that compensation for the cycling stress on the battery is compensated adequately. Technology is still under development with Japanese manufacturers taking the lead.

A future of autonomous, connected, electric and shared vehicles

As electric vehicles modify our perception of private cars, other trends will further impact the way we use vehicles.

Shared mobility services, like Uber, Didi and Lyft have redefined our approach to transportation. Increasingly cars are seen as a simple means of transportation rather than a required ownership or a sentimental value. Autonomous driving has redefined the utility of cars. Connected and electric cars are steering to us towards a world of cleaner and smarter energy.

How far are we from a world where cars are not sitting idle in a parking but driving themselves (to where they are most needed) either to transport passengers on demand or to a location where they can be monetised to answer to grid constraints?